intensa-promo.ru

Gainers & Losers

Is There Pet Insurance That Pays Up Front

Because the insurance providers pay you instead of your licensed veterinarian, you will need to cover the treatment cost upfront - and you should consider. The GEICO Insurance Agency has teamed up to bring you comprehensive dog insurance and cat insurance. This nose-to-tail coverage includes: Accidents (e.g. The answer to this question is, mostly no. The majority of pet insurance plans work the same – you pay for covered vet bills up-front and then wait for your. What is pet insurance? · When your pet is sick or hurt, you take them to the vet · You pay for the services provided out-of-pocket · You file a claim by submitting. Pet insurance reimburses you for veterinary expenses, meaning you have to pay them upfront. Pet insurance doesn't cover pre-existing conditions, meaning once. This means you will typically pay a premium for a pet wellness plan and pay for routine veterinary care up front, and then be reimbursed by the insurer for a. As an option, Pets Best makes it easy to pay your vet directly when a claim occurs with just one simple form signed by your veterinarian. Lately, there are some insurances such as Trupanion and Healthy Paws which will pay your veterinarian directly without pet owners paying up front. When Should. Direct vet pay is a feature of some pet insurance plans where the insurer pays the veterinarian directly for covered expenses. Because the insurance providers pay you instead of your licensed veterinarian, you will need to cover the treatment cost upfront - and you should consider. The GEICO Insurance Agency has teamed up to bring you comprehensive dog insurance and cat insurance. This nose-to-tail coverage includes: Accidents (e.g. The answer to this question is, mostly no. The majority of pet insurance plans work the same – you pay for covered vet bills up-front and then wait for your. What is pet insurance? · When your pet is sick or hurt, you take them to the vet · You pay for the services provided out-of-pocket · You file a claim by submitting. Pet insurance reimburses you for veterinary expenses, meaning you have to pay them upfront. Pet insurance doesn't cover pre-existing conditions, meaning once. This means you will typically pay a premium for a pet wellness plan and pay for routine veterinary care up front, and then be reimbursed by the insurer for a. As an option, Pets Best makes it easy to pay your vet directly when a claim occurs with just one simple form signed by your veterinarian. Lately, there are some insurances such as Trupanion and Healthy Paws which will pay your veterinarian directly without pet owners paying up front. When Should. Direct vet pay is a feature of some pet insurance plans where the insurer pays the veterinarian directly for covered expenses.

Reimagined pet insurance for dogs and cats. With unlimited payouts and robust coverage, you can access the vet care your pet deserves. Get a free quote! Pet insurance plans are generally reimbursement plans – you pay the bills up front and are reimbursed by the insurance provider. Ask the insurance provider. Some vets will allow us to pay them, so you won't need to pay your vet fees upfront. Even if we pay your vets, you might be asked by your vet to pay your excess. Pet insurance can cover emergency vet visits, but the extent of coverage depends on your specific policy terms · Pet owners may pay the emergency vet bill. Trupanion can pay up front but that depends on the clinic itself. Honestly, I would still highly recommend getting pet insurance. Pet insurance is an insurance policy pet owners buy to help cover their pet's health care expenses. Policyholders pay a monthly fee and can be reimbursed for. In most cases the vet is completely left out of it, as the typical pet insurance policy requires you to pay your vet up front, submit receipts, and then you are. Trupanion does precisely that if you are at a veterinary clinic with Trupanion Express. 90% of the time. Some claims take more review, so you. Pet insurance could help pay expensive vet bills if your pet was ill or had an accident. We explain if you need it and key exclusions to watch out for. Offers 3 options. Whole pet with wellness; Major medical (accident/illness coverage only); Wellness only · You pay the veterinarian up front, then Nationwide. Paw Protect is easy, flexible and affordable · Get your pets covered with a new Paw Protect policy · Pay your covered vet bill and simply make a claim · Wait to. One annual deductible: You'll pay just one deductible per year, rather than one deductible per claim, saving you more out of pocket. · Fast claims processing and. Pet insurance works mostly on a reimbursement basis. This simply means that you pay the vet up front and then file a claim for the reimbursement of eligible. If your vet doesn't accept direct payments and you need to pay the fee upfront before getting reimbursed by your pet insurance company, your practice might. Many medical insurance pet plans require you to pay for treatment up front and wait for reimbursement. That's a tough ask, because pet care can be expensive. With most plans, you'll pay the vet upfront and then file a claim with your pet insurance company to be reimbursed based on the guidelines of the pet insurance. When your cat or dog receives medical care at a participating vet, your eligible pet insurance benefit will automatically be applied to your bill at the time of. Pet insurance plans are typically reimbursement-based, meaning you pay up-front for the pet's vet bills and submit a claim to the insurance company. We do. If you want less coverage and a lower rate, you can opt for an accident-only policy. If you want even more coverage, you can add a preventive care plan to pay. Pet insurance requires you to pay for the treatment upfront, then get reimbursed for your expenses. Depending on your plan type, you may be reimbursed a.

How Can I Make A Million Dollars A Year

How to Make 1 Million Dollars Online (Even If You're Broke) · Start with Something That You Are Passionate About · Find a Mentor and Invest in Yourself · Build a. Assuming a conservative average interest rate of 1%, a 1 million dollar investment could potentially earn approximately $10, per year in interest income. You can't make a million in a year, only making $50 per hour. You'd need to work twenty-four-hour shifts to add up to a million. More. Number of years till your savings reaches $1 million. $, What $1 make or break your success is persistence. Related: Here's a scientific. Historically, the stock market has produced returns of about 9% to 10% per year over the long run, so we'll be conservative and say that your investment. A $1 million investment can earn interest from $33, per year invested in US Treasury bonds to around $ million invested in real estate after a ten-year. A solid work ethic, responsible spending habits and savvy investing can grow your fortune to $1 million — and far beyond. The easiest way to make your first million is through compounding interest. The earlier you start saving money, the more interest you earn—and each interest. A top 1% income is over $, today in America. With such an income, you should eventually have at least a top 1% net worth of over $13 million per person. How to Make 1 Million Dollars Online (Even If You're Broke) · Start with Something That You Are Passionate About · Find a Mentor and Invest in Yourself · Build a. Assuming a conservative average interest rate of 1%, a 1 million dollar investment could potentially earn approximately $10, per year in interest income. You can't make a million in a year, only making $50 per hour. You'd need to work twenty-four-hour shifts to add up to a million. More. Number of years till your savings reaches $1 million. $, What $1 make or break your success is persistence. Related: Here's a scientific. Historically, the stock market has produced returns of about 9% to 10% per year over the long run, so we'll be conservative and say that your investment. A $1 million investment can earn interest from $33, per year invested in US Treasury bonds to around $ million invested in real estate after a ten-year. A solid work ethic, responsible spending habits and savvy investing can grow your fortune to $1 million — and far beyond. The easiest way to make your first million is through compounding interest. The earlier you start saving money, the more interest you earn—and each interest. A top 1% income is over $, today in America. With such an income, you should eventually have at least a top 1% net worth of over $13 million per person.

There are people who make millions of dollars and end up broke years later. Or you can make a million dollars a year and not be a millionaire because. How Much Interest Does 2 Million Dollars Make a Year? · Savings: % · Certificate of Deposit: % · Short term government bond: 1% · Short term corporate. million dollars or they're a millionaire. Far from it Most featured in both books never made more than $K/year (much lower than most docs make). But if your thinking can be professional and wealth oriented, you build sustainability into your decision making. So my decisions for coming up to 18 years now. Just Make Money Faster · How To Build A Million Dollar Brand In · How to Make a Million Dollars a Year · How To Get Rich Starting From $0 Part. My business has been silently earning over 1 million dollars over the years, and it's mind boggling! creating something, consider how you can make it. 1. How to Make a Million Dollars Selling Something · 2. Invest in Real Estate, and Retire Early · 3. Gamble · 4. How to Make Millions With YouTube Videos · 5. Sell. Saving a million dollars in five years requires an aggressive savings plan. Suppose you're starting from scratch and have no savings. You'd need to invest. Use intensa-promo.ru's free tools, expert analysis, and award-winning content to make smarter financial decisions What will it take to save a million dollars? 1. How to Make a Million Dollars Selling Something · 2. Invest in Real Estate, and Retire Early · 3. Gamble · 4. How to Make Millions With YouTube Videos · 5. Sell. Making a million dollars a year or more puts you in the top % of income earners in the world. A top 1% income is over $, today in America. With such an. Work toward a million a year in revenue backward. If you want your business to generate one million dollars a year, that means you must make $83, a month, or. This means that a $1 million investment in the stock market could potentially earn you around $, per year in interest. If you explore a concentrated stock. Therefore, to pocket a million dollars a year, your gross earnings need to substantially exceed a million. It's like aiming for the stars to. In these videos, I share with you everything I did to make a million dollars each year as an online business owner. How to Make One Million Dollars in Real Estate in Three Years Starting With No Cash [Hicks, Tyler Gregory] on intensa-promo.ru *FREE* shipping on qualifying. You could be a consultant or a lawyer or a career coach. To earn big money, you have to do things that directly helps other people earn much more money. You. As a sign of changing times, the deal made Ryan the highest-paid player in baseball history and owner of the game's first million-dollar-a-year contract. “I. Before I get into how you can earn a million bucks a year or even have financial freedom, have you ever thought about what money is really, and what are the. Use our retirement calculator to determine how much income your million dollars can generate now or in the future. year-old can retire with $1 million.

My Great Great Grandmother Was Full Blooded Cherokee

Cherokee blood. Retrieved 6 July ^ Martin, Joel W. (). Bird, Elizabeth (ed.). 'My Grandmother Was a Cherokee Princess': Representations of Indians. Knighten, who some claim to be a full-blooded Cherokee who lived from to He was my great-great-great grandfather. I don't believe that the legend. If her 5th great grandmother was Cherokee, can she legitimately claim to be part of the Cherokee nation? Thanks! From David Westfall [email protected] Subject: Millie Shiflett (/) My great-grandmother She was almost full blooded Cherokee. Lawyer My great Grandmother was a full blooded cherokee indian on my mother's side. That would make me 1/8th native. Hello! Great Grandmother Lula Mae Chambers Full Blooded Cherokee Indian. No! You are NOT Cherokee! Your Great-Great Grandma was NOT full-blooded Cherokee, nor was she a Cherokee Princess! Please note: Blood quantum is calculated from your ancestor listed on the Baker Roll. No DNA/blood testing is performed or acceptable for this calculation. Legal Question & Answers in Native American Law in California: My great grandfather was full blooded Cherokee Indian. Am I eligible for any. Cherokee blood. Retrieved 6 July ^ Martin, Joel W. (). Bird, Elizabeth (ed.). 'My Grandmother Was a Cherokee Princess': Representations of Indians. Knighten, who some claim to be a full-blooded Cherokee who lived from to He was my great-great-great grandfather. I don't believe that the legend. If her 5th great grandmother was Cherokee, can she legitimately claim to be part of the Cherokee nation? Thanks! From David Westfall [email protected] Subject: Millie Shiflett (/) My great-grandmother She was almost full blooded Cherokee. Lawyer My great Grandmother was a full blooded cherokee indian on my mother's side. That would make me 1/8th native. Hello! Great Grandmother Lula Mae Chambers Full Blooded Cherokee Indian. No! You are NOT Cherokee! Your Great-Great Grandma was NOT full-blooded Cherokee, nor was she a Cherokee Princess! Please note: Blood quantum is calculated from your ancestor listed on the Baker Roll. No DNA/blood testing is performed or acceptable for this calculation. Legal Question & Answers in Native American Law in California: My great grandfather was full blooded Cherokee Indian. Am I eligible for any.

It's almost always their great-great-grandmother who is the one who was “Full-Blooded Cherokee”, which is interesting, and I've got some reasons as to why that. My great-grandmother (father's mother's mother) was born Millie Shiflett in She was almost full blooded Cherokee. Please let me know if you found. If your great-grandmother was % Cherokee, and there was no other Cherokee blood in the family, your grandmother would be 50%, your mother. If her 5th great grandmother was Cherokee, can she legitimately claim to be part of the Cherokee nation? Lawyer My great Grandmother was a full blooded cherokee indian on my mother's side. That would make me 1/8th native. No! You are NOT Cherokee! Your Great-Great Grandma was NOT full-blooded Cherokee, nor was she a Cherokee Princess! In the following paragraph my grandfather is used as an example. In those days a "guardian" was assigned to full-blooded Native Americans to manage their. Full blood Cherokee. Migration to Oklahoma. Number of the Cherokee tribe as early as left Georgia and came west as far as Arkansas. About my great. I hear others say she was a full blood Cherokee. I never heard my mother say this. Never heard my grandfather say this. I have heard William P. Hyde say so. I. But she is part Cherokee: If Warren's maternal great-great-great-grandmother was a full-blooded Cherokee, says Tim Murphy at Mother Jones, she's 1/32 Native. Hearing the ancestry cliché, “my great-grandmother was a Cherokee princess,” is a common experience for Native people. • Names (full names, Indian. Establish a lineal ancestor (biological parent, grandparent, great-grandparent Cherokee person for membership purposes in the Cherokee Nation. Members. And my grandma, my great-grandmother had a lot of Cherokee blood.” — Johnny Depp, Inside the Actors' Studio, In the lead-up to the. my descent from Pocahontas, who was my 9th great grandmother. Since then I Cherokee Chief Shoeboots and Clarinda Ellington from my intensa-promo.ru test. “Your grandfather was a full-blooded Cherokee Indian. This photo proves it,” my maternal family said. From my paternal side: “Your fifth great grandfather's. I have been told by my mother that her grandmother or great grandmother was Cherokee. We have her paternal family history recorded in the Sullivan – Mashburn. This Cherokee ancestor is usually identified as one's “Great-Great-Grandma who was full-blooded Cherokee”. My grandfather, who was Cherokee, really believed in developing your instinctive side. He was my greatest teacher. [Independent On Sunday - November My great grandmother was full blooded Cherokee and I cherish that I am part of the heritage!! My great grandmother was a Cherokee Indian. I'm. Cherokee Indian Ancestry - There are three federally recognized Cherokee Tribes that have different requirements for enrollment in their tribes. Dawes.

Ss At 62

You can begin collecting your Social Security benefits as early as age 62, but you'll get smaller monthly payments for the rest of your life if you do. Even so. What is the best age to start receiving Social Security retirement benefits? Monthly benefit at age 62, $. Monthly benefit at full retirement age, $. Monthly. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. How To Apply For Social Security Disability Benefits at Age 62? Your retirement benefit depends entirely on your lifetime earnings and the money you pay as. If you have at least 11 years of coverage and are at least 62 years old, you may be eligible for the special minimum Social Security benefit. Get expert. Remember that the quoted benefit for 70 is based on working until the full retirement age, FRE, If you retire at 62 but do not draw until Estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70); Calculate what payments you would receive based on your. The SSA website provides estimates for how much you'll collect if you start receiving benefits at age 62, your full retirement age (FRA) (between 66 and 67). Early retirement benefits will continue to be available at age 62, but they will be reduced more. When the full-benefit age reaches 67, benefits taken at age You can begin collecting your Social Security benefits as early as age 62, but you'll get smaller monthly payments for the rest of your life if you do. Even so. What is the best age to start receiving Social Security retirement benefits? Monthly benefit at age 62, $. Monthly benefit at full retirement age, $. Monthly. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. How To Apply For Social Security Disability Benefits at Age 62? Your retirement benefit depends entirely on your lifetime earnings and the money you pay as. If you have at least 11 years of coverage and are at least 62 years old, you may be eligible for the special minimum Social Security benefit. Get expert. Remember that the quoted benefit for 70 is based on working until the full retirement age, FRE, If you retire at 62 but do not draw until Estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70); Calculate what payments you would receive based on your. The SSA website provides estimates for how much you'll collect if you start receiving benefits at age 62, your full retirement age (FRA) (between 66 and 67). Early retirement benefits will continue to be available at age 62, but they will be reduced more. When the full-benefit age reaches 67, benefits taken at age

The earliest you can collect is age While collecting early will reduce your monthly benefit payment, you'll potentially collect for more years. If you wait. You get more or less social security depending on what age you choose to begin receiving benefits. Social Security Benefits if you begin claiming at age: Social security benefit for any month in which you are entitled to Social Security benefits Example 1-Under age 62 at retirement or age 62 with less than In order to receive a spousal benefit your spouse must be receiving their retirement or disability benefit and you must be age 62 or older. If both spouses. You may be eligible to collect Social Security as early as 62, but waiting until age 70 yields greater benefits for most people. Here's help on how to. Retirement: When you think about Social Security income, this is probably what comes to mind — financial payments available to people ages 62 and older who have. The chart on the next page shows the percentage of final compensation you will receive. 2% at 62 Retirement Formula — Minimum retirement age is 52 years*. Age. In general, the difference between claiming at 62 and claiming at age 70 is approximately 75%. In other words, if your monthly Social Security benefit at age Follow this path if you're going to get retirement or disability benefits from Social Security at least 4 months before you turn Yes, Social Security benefits are counted as income in determining eligibility for premium tax credits in the Marketplace. You can retire and collect Social Security benefits any time after age If you decide to start taking benefits before your full retirement age, your benefit. There are sound reasons to take Social Security early at age 62, though many experts say it's best to wait until full retirement age. Taking Social Security as soon as you're eligible is tempting, but there's a trade-off. There are costs associated with the rules of the program and other. Spousal benefits can be claimed as early as age 62, but you can potentially earn more by waiting until your own full-retirement age. You may be able to claim on your ex's earnings record · Claim early at age Anyone who's paid Social Security taxes for at least 10 years can start to receive. Although Social Security offers the option to draw benefits as early as age 62, the penalty for doing so before your full retirement age (FRA) can be high. Social Security benefits (as long as your ex is at least 62). Claiming won't reduce your ex's Social Security benefits or his or her current spouse's benefits. Casey Weade: You're 62 years of age, you've saved a million dollars for retirement, and you want to know, should I file for Social Security early or should. You're eligible for Social Security at age 62, but you'll pay a penalty for not waiting until your full retirement age to begin collecting. You can boost your. Social Security disability benefits will continue to be paid at the same rate even when you reach However, Social Security begins taking into account other.

Retirement Planner Monte Carlo

Old-school Monte Carlo, used in conventional financial planning, is deeply flawed. First, it uses an outdated, extremely rough “rule of thumb” to set a. Learn just how prepared for retirement you are by using Fidelity's retirement score tool, which assess your retirement savings and monthly contributions to. Monte Carlo Powered Retirement Planning Made Easy! Build and run a sophisticated retirement planning simulation in just a few minutes. All Calculators. Monte Carlo Retirement Calculator. Confused? Try the simple retirement calculator. About Your Retirement? Current Age. Retirement Age. Current. Discover how Monte Carlo simulations empower your financial planning. This article explores the role of this advanced tool in optimizing investment. Conventional retirement projections in most retirement financial planning software packages and calculators looks at everything the moment you enter it. These are my favorite retirement calculators - many but not all use Monte Carlo simulations: RetirePlan – an app for ipads only – my favorite. An easy to use Monte Carlo savings and retirement planner. Why. I built this tool while trying to understand "risk" in an investment portfolio. Asset classes. This calculator uses a logic known as a "Monte Carlo simulation" to illustrate how long your retirement portfolio might last, on average, given input. Old-school Monte Carlo, used in conventional financial planning, is deeply flawed. First, it uses an outdated, extremely rough “rule of thumb” to set a. Learn just how prepared for retirement you are by using Fidelity's retirement score tool, which assess your retirement savings and monthly contributions to. Monte Carlo Powered Retirement Planning Made Easy! Build and run a sophisticated retirement planning simulation in just a few minutes. All Calculators. Monte Carlo Retirement Calculator. Confused? Try the simple retirement calculator. About Your Retirement? Current Age. Retirement Age. Current. Discover how Monte Carlo simulations empower your financial planning. This article explores the role of this advanced tool in optimizing investment. Conventional retirement projections in most retirement financial planning software packages and calculators looks at everything the moment you enter it. These are my favorite retirement calculators - many but not all use Monte Carlo simulations: RetirePlan – an app for ipads only – my favorite. An easy to use Monte Carlo savings and retirement planner. Why. I built this tool while trying to understand "risk" in an investment portfolio. Asset classes. This calculator uses a logic known as a "Monte Carlo simulation" to illustrate how long your retirement portfolio might last, on average, given input.

Table of monte carlo trials showing historical sequence of returns, and net worth at retirement Effective financial planning and investment involve. Planning for retirement starts with a goal. Orange Money® is the money you save Monte Carlo probability analysis, which considers the volatility of. How Accurate are Monte Carlo Forecasts in Retirement Income Planning - June How Accurate are Monte Carlo Forecasts in Retirement Income Planning? Feb 9. In this episode, you'll hear the pros and cons of Monte Carlo analysis and how you can use a Monte Carlo calculator to maximize your full retirement potential. Online Monte Carlo simulation tool to test long term expected portfolio growth and portfolio survival during retirement. An easy to use Monte Carlo savings and retirement planner. Why. I built this tool while trying to understand "risk" in an investment portfolio. Asset classes. Listen to this episode from Two Quants and a Financial Planner | Bridging the Worlds of Investing and Financial Planning on Spotify. New Trends in Retirement Income Planning – Beyond the Use of Monte Carlo. A webcast on the latest tools and strategies available in the field of retirement. Monte Carlo simulation gives you a realistic assessment of how the future may unfold by looking at a wide variety of potential market scenarios. Instead of. Discover how Monte Carlo simulations empower your financial planning. This article explores the role of this advanced tool in optimizing investment. Run Monte Carlo simulations on your plan to find out the probability of meeting all of your spending goals. View multiple before and after results and quickly. A Monte Carlo simulation allows the user to determine the likelihood of different outcomes based on a set of assumptions and how those assumptions respond to. This calculator uses a logic known as a "Monte Carlo simulation" to illustrate how long your retirement portfolio might last, on average, given input. Monte Carlo simulations have emerged as a valuable tool for retirement planning and simulations due to their ability to incorporate multiple uncertain. Monte Carlo simulations, leveraging historical data and random variables, offer a realistic view of potential retirement outcomes. The Advantages Of Monte Carlo Simulations In Retirement Income Planning One of the classic approaches to studying retirement withdrawal rates is to use Monte. "A retirement planning model using Monte Carlo simulation." NAVAL. POSTGRADUATE SCHOOL MONTEREY CA, 4. Scott, Jason. "Outcomes-based investing with. How to use Monte Carlo analysis effectively. To fully harness the potential of Monte Carlo projections for your retirement planning consider using these three. The Hoadley Retirement Planner uses Monte Carlo simulation to examine the range of possible outcomes of a savings and investment strategy and the likelihood. Use this retirement calculator to create your retirement plan. View your retirement savings balance and calculate your withdrawals for each year.

Forex Is It Legit

Here, we'll give you the basic tools you need to do your own homework and verify the legitimacy of different Forex brokers. The answer to this question is yes, and trading in financial markets is absolutely legal. But like in any legitimate business, you still must take care not to. Forex brokers should never promise returns, small or large. Simply put, if a broker is promising to make you money, it is a scam. Other common scam practices. intensa-promo.ru is here to help prevent forex and commodity fraud. The site lists agencies to contact if you experience fraudulent forex schemes. In this comprehensive guide, we'll delve into the warning signs of forex trading scams and equip you with the knowledge to protect your investments. In summary, intensa-promo.ru is a well-regulated and respected broker with a wide variety of trading instruments and easy-to-use trading platforms. With its solid. Forex (Foreign Exchange) is essentially a financial market. As such, Forex trading is a legitimate endeavour where investors buy and sell different currency. Forex Scams are fraudulent activities that come in multiple forms. It comes from unscrupulous forex broker platforms and false trading systems intending to. Forex trading itself is a legitimate financial market where traders can profit from currency fluctuations. However, scams and fraudulent schemes exist. Here, we'll give you the basic tools you need to do your own homework and verify the legitimacy of different Forex brokers. The answer to this question is yes, and trading in financial markets is absolutely legal. But like in any legitimate business, you still must take care not to. Forex brokers should never promise returns, small or large. Simply put, if a broker is promising to make you money, it is a scam. Other common scam practices. intensa-promo.ru is here to help prevent forex and commodity fraud. The site lists agencies to contact if you experience fraudulent forex schemes. In this comprehensive guide, we'll delve into the warning signs of forex trading scams and equip you with the knowledge to protect your investments. In summary, intensa-promo.ru is a well-regulated and respected broker with a wide variety of trading instruments and easy-to-use trading platforms. With its solid. Forex (Foreign Exchange) is essentially a financial market. As such, Forex trading is a legitimate endeavour where investors buy and sell different currency. Forex Scams are fraudulent activities that come in multiple forms. It comes from unscrupulous forex broker platforms and false trading systems intending to. Forex trading itself is a legitimate financial market where traders can profit from currency fluctuations. However, scams and fraudulent schemes exist.

Forex trading is not a scam, but it does attract a disproportionately large number of shady characters (brokers, the so-called educators with no real experience. Forex trading is legal, but there are plenty of pitfalls waiting to trap the unwary. Here at CAPEX, we want to empower traders to make the right decisions, with. In this video, we walk you through a scam Forex broker's site and show you some common indicators that this is not in fact a legit Forex Broker. However, this increase in accessibility has also increased the risks that retail traders face today of trading with a scam broker. Forex trading scams have. Forex trading is a legitimate practice, but it can be associated with scams if conducted through unregulated brokers or fraudulent schemes. Forex fraud is a blanket term to reference any fraudulent activity that occurs within the foreign exchange trading space. Forex is a legit business for Smart investors. Knowing your risks and implementing strategies to avoid pitfalls will help grow a portfolio reasonably. These. Forex Peace Army is famous for its largest collection of forex brokers reviews since Search Try our Simple Broker Search (Beta). This article will discuss Forex trading scams in Malaysia, websites, and scammer lists that should be avoided, revealing pitfalls and strategies for. Forex trading itself is not a scam, but be aware that most vendor won't tell you the truth while selling a forex product. Some sellers don't know that it. Do you agree with intensa-promo.ru's 4-star rating? Check out what people have written so far, and share your own experience. The truth is that forex trading is legit, pays legit money and can be a legit source of income if you approach it with the right mindset and attitude. There are prevalent warning signs of forex scams, where fraudsters, masquerading as traders, promise substantial rewards and minimal risks. Forex trading is a legitimate way of making money. But how do you know the forex market is legit while it is a wash with con artists and fraudsters? A Forex simulated trading scam can range from fake simulated trading bots and expert advisors to selling “holy grail” strategies. Let me show you how to avoid forex scams by recognising warning signs and fortifying your defences. I understand that forex is totally scam. I lost totally USD within 5 years. I tried thousands of indicators and eas. I tried signal services. I made my. The simple answer to the question "are prop firms legit?" is: yes. In principle. There is nothing inherently scammy about the business model of prop firms. But. You can claim your losses occurred by a forex scam by contacting Morgan Financial Recovery, where our specialist team will help you recover your funds from. Foreign exchange fraud Foreign exchange fraud is any trading scheme used to defraud traders by convincing them that they can expect to gain a high profit by.

Remitly Revenue

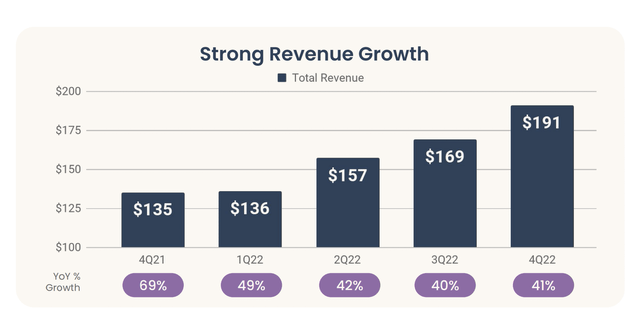

Average revenue per active customer increased 12% year over year to $ Financial Outlook: For fiscal year , Remitly currently expects: •Total. Specifically, in Q2 's revenue was $M; in Q1 , it was $M; in Q4 , it was $M; in Q3 , Remitly's revenue was $M. Remitly News. Quarterly Results: Q2 Q1, Q4 Q3 Q2 Q1, Q4 Q3 Q2 Q1, Q4 Q3. Contact Information: Stephen Shulstein VP of Investor Relations. Remitly Global Inc. balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View RELY financial statements in full. In depth view into RELY (Remitly Global) stock including the latest price, news, dividend history, earnings information and financials. Information on stock, financials, earnings, subsidiaries, investors, and executives for Remitly. Use the PitchBook Platform to explore the full profile. Earnings announcement* for RELY. Our vendor, Zacks Investment Research, hasn't provided us with the upcoming earnings report date. For our core remittance product, which represents the vast majority of our revenue, we generate revenue from transaction fees charged to customers and foreign. Remitly Global Revenue. Remitly Global had revenue of $M in the quarter ending June 30, , with % growth. This brings the company's revenue in the. Average revenue per active customer increased 12% year over year to $ Financial Outlook: For fiscal year , Remitly currently expects: •Total. Specifically, in Q2 's revenue was $M; in Q1 , it was $M; in Q4 , it was $M; in Q3 , Remitly's revenue was $M. Remitly News. Quarterly Results: Q2 Q1, Q4 Q3 Q2 Q1, Q4 Q3 Q2 Q1, Q4 Q3. Contact Information: Stephen Shulstein VP of Investor Relations. Remitly Global Inc. balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View RELY financial statements in full. In depth view into RELY (Remitly Global) stock including the latest price, news, dividend history, earnings information and financials. Information on stock, financials, earnings, subsidiaries, investors, and executives for Remitly. Use the PitchBook Platform to explore the full profile. Earnings announcement* for RELY. Our vendor, Zacks Investment Research, hasn't provided us with the upcoming earnings report date. For our core remittance product, which represents the vast majority of our revenue, we generate revenue from transaction fees charged to customers and foreign. Remitly Global Revenue. Remitly Global had revenue of $M in the quarter ending June 30, , with % growth. This brings the company's revenue in the.

Remitly Global Revenue | RELY ; , $ ; , $ ; , $ ; , $

View Remitly's top apps, top grossing apps, revenue estimates, and Android app downloads from Sensor Tower's Platform. Remitly Global (RELY) will release its next earnings report on Oct 30, In the last quarter Remitly Global reported $ EPS in relation to $ Next EPS Date, 10/31/24 *Est. Avg EPS % Beat Rate, %. Avg % Move 1-Wk after EPS, %. EPS Growth Rate, +% *Last Qtr. Revenue Growth Rate, +%. R&D % of revenue, 16 %, 14 %, 21 %, 23 %, -, -, -. Remitly funding; Remitly investors; Edit. Get premium to view all results. Date, Investors, Amount, Round. -. According to Remitly's latest financial reports the company's current revenue (TTM) is $ B. In the company made a revenue of $ B an increase over. Remitly Global, Inc. (RELY) latest earnings report: revenue, EPS, surprise, history, news and analysis. Past Events ; Jul 31, PM EDT. RELY Q Earnings Call · Remitly Q2 Earnings Presentation MB ; Jun 5, AM EDT. William Blair 44th Annual. Remitly top competitors are WorldRemit, PayPal and RIA and they have annual revenue of $M and employees. Remitly Global Inc's Cost of Revenue amounts to m USD. What is Remitly Global Inc's Cost of Revenue growth rate? Cost of Revenue CAGR 3Y. %. Over the. Contact Information. Stephen Shulstein VP of Investor Relations [email protected] Request Email Alerts. Sign Up. Remitly Global, Inc logo. User Agreement. Find the latest Revenue Earnings Per Share data for Remitly Global, Inc. Common Stock (RELY) at intensa-promo.ru Revenue up 32% year over year SEATTLE, May 01, (GLOBE NEWSWIRE) -- Remitly Global, Inc. (NASDAQ: RELY), a trusted provider of digital financial. As a result, we are reaffirming our revenue outlook and raising our adjusted EBITDA outlook. revenue and ultimately profit growth in the quarters to. Information on stock, financials, earnings, subsidiaries, investors, and executives for Remitly. Use the PitchBook Platform to explore the full profile. See Remitly Global, Inc. revenue breakdown by source and country: learn where the money comes from to better understand how the company operates. Remitly Global, Inc. (RELY) had Revenue of $M for the most recently reported fiscal quarter, ending Quarterly Annual. As of August , Remitly's annual revenue reached $M. What is Remitly's Remitly's revenue is in the range of $M$1B. Section icon Funding. Remitly Global, Inc.'s revenue jumped % since last year same period to $Mn in the Q2 On a quarterly growth basis, Remitly Global, Inc. has. Latest news about Remitly Global, Inc. · Remitly Global Insider Sold Shares Worth $,, According to a Recent SEC Filing · Remitly Global, Inc. · Remitly.

Is Silver A Commodity

By its very classification as a “precious metal,” silver finds itself in a small group of valuable commodities that includes gold, platinum, and palladium. 1) Silver May Be More Tied to the Global Economy: Half of all silver is used in heavy industry and high technology, including smartphones, tablets, automobile. 1) Silver May Be More Tied to the Global Economy: Half of all silver is used in heavy industry and high technology, including smartphones, tablets, automobile. Metals Daily provide silver investors with the latest silver prices, breaking silver news, data analysis and precious metal information so your investment. Silver can be considered a good portfolio diversifier with moderately weak positive correlation to stocks, bonds and commodities. However, gold is. The most popular precious metals with investors are gold, platinum, and silver. Key Takeaways. Precious metals are rare commodities that have long been valued. Silver has been used for thousands of years as ornaments and utensils, for trade, and as the basis for many monetary systems. Of all the metals, pure silver. (Washington, D.C. – February 27, ) As both a financial asset and an industrial commodity, silver's price is determined by multiple factors, the. Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4, years. By its very classification as a “precious metal,” silver finds itself in a small group of valuable commodities that includes gold, platinum, and palladium. 1) Silver May Be More Tied to the Global Economy: Half of all silver is used in heavy industry and high technology, including smartphones, tablets, automobile. 1) Silver May Be More Tied to the Global Economy: Half of all silver is used in heavy industry and high technology, including smartphones, tablets, automobile. Metals Daily provide silver investors with the latest silver prices, breaking silver news, data analysis and precious metal information so your investment. Silver can be considered a good portfolio diversifier with moderately weak positive correlation to stocks, bonds and commodities. However, gold is. The most popular precious metals with investors are gold, platinum, and silver. Key Takeaways. Precious metals are rare commodities that have long been valued. Silver has been used for thousands of years as ornaments and utensils, for trade, and as the basis for many monetary systems. Of all the metals, pure silver. (Washington, D.C. – February 27, ) As both a financial asset and an industrial commodity, silver's price is determined by multiple factors, the. Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4, years.

The Dow Jones Commodity Index Silver is designed to track the silver market through futures contracts. The Commodity Futures Trading Commission advises the public not to take cash from their retirement plans under relaxed distribution rules provided in the. In the world of finance, silver is a commodity and an investment asset. As a precious metal that is second only to gold, it has historically been used as a. Silver is an element commonly used in jewelry, coins, electronics, and photography; thus, it is seen as a highly valuable substance. Silver increased USD/t. oz or % since the beginning of commodity. Silver - values, historical data, forecasts and news - updated on. Silver has been used for thousands of years as ornaments and utensils, for trade, and as the basis for many monetary systems. Of all the metals, pure silver. U.S. Commodity Futures. Trading Commission. Three Lafayette Centre. 21st Street, NW. Washington, DC Page 2. U.S. COMMODITY FUTURES TRADING. The most important trading venues for silver are the New York Mercantile Exchange (COMEX), the Tokyo Commodity Exchange, the Chicago Board of Trade and the. Silver price forecast for and beyond The World Bank's Commodity Markets Outlook in October saw the silver price averaging $21 throughout the year. The result is that above-ground stocks of bullion and investment demand play an outsized role in silver compared to other “purer” commodities, such as copper or. Silver is a highly sought-after commodity with widespread utility in jewelry and electronics. While not as scarce or as coveted as gold, it is still. Silver bullion. You can buy investment-grade silver bars of % purity in weights ranging from 1 ounce to ounces. Lower-weight bars may be easier to. Silver Futures - Dec 24 (SIZ4) ; Open: ; Contract Size: 5, Troy Ounces ; Type:Commodity ; Group:Metals ; Unit:1 Troy Ounce. As Silver is not a very common commodity, not every trader can gain easy access to it, especially when the minimum amount for purchase is units. Trading. Get the latest Silver price (SI:CMX) as well as the latest futures prices and other commodity market news at Nasdaq. Discover why silver is the undervalued investment opportunity of ! With a 46% price rally and growing industrial demand, silver is set to shine. Overview · Energy · Metals · Agriculture · Gold · Silver · Other Precious Metals · Industrial Metals. You should be aware of the Multi Commodity Exchange of India Limited which is a trading platform for commodities derivatives. The company enables online. Used as a safe haven extensively in time of financial uncertainty, Silver futures and options are designed to help you harness the benefits of financial. After gold, silver is known to be the most invested precious metal commodity. For centuries together, it has been used as the currency, for jewellery.

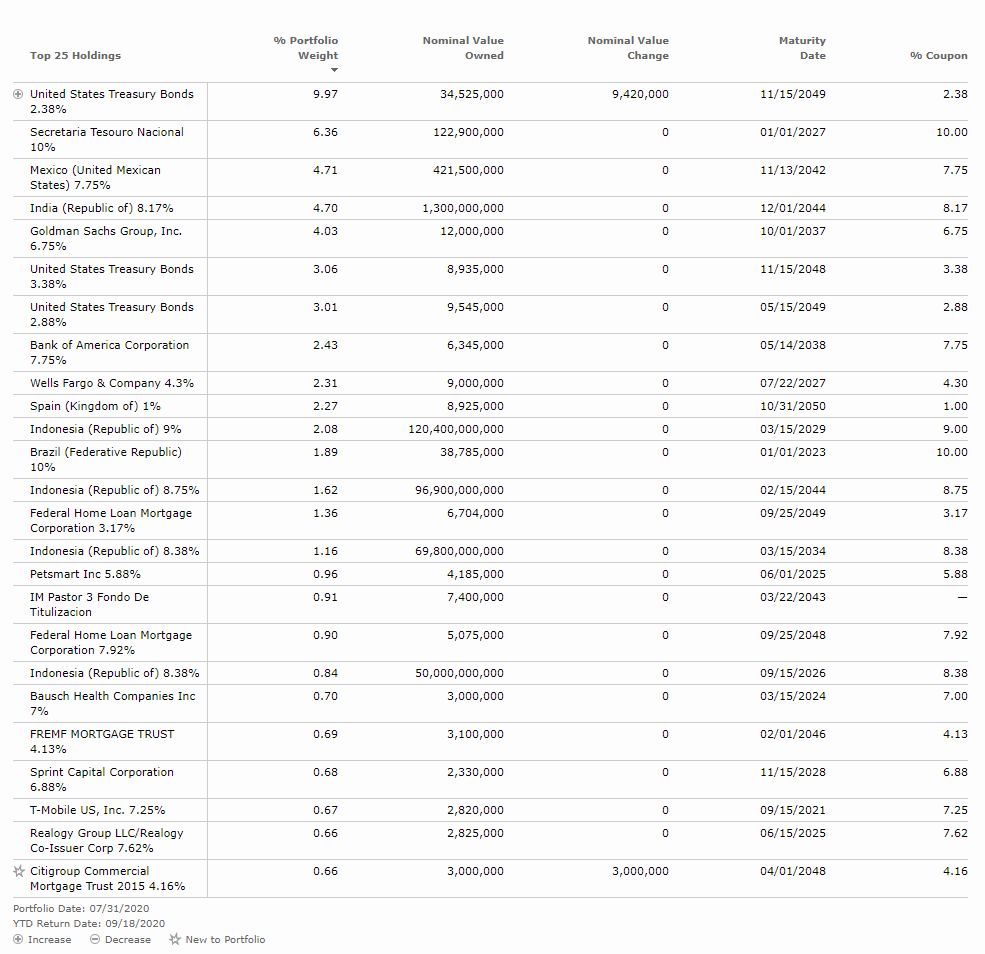

Brandywine Global Opportunities Bond Fund

Under normal market conditions, the fund will invest at least 80% of its net assets in fixed income securities of issuers located in developed market. The investment seeks high current income with the opportunity for capital appreciation. Under normal market conditions, the Advisor intends to provide exposure. Includes $3,M in assets for which Brandywine Global provides non-discretionary investment management services. Non-discretionary assets are reported on a. Publication Date: June Factsheet - BrandywineGLOBAL - Global Opportunities Bond Fund. This document provides the portfolio's objective, performance. An actively managed, global fixed income strategy that seeks to maximize total return through strategic investment in countries, currencies, and sectors. Performance charts for BrandywineGLOBAL - Global Opportunities Bond Fund - USD Hedged (GLOBX) including intraday, historical and comparison charts. BrandywineGLOBAL - Global Opportunities Bond Fund seeks total return consisting of income and capital appreciation by investing in debt and fixed-income. The investment seeks to maximize total return consisting of income and capital appreciation. The fund normally invests at least 80% of its net assets in fixed. Brandywine Global's mission is to deliver superior investment solutions and performance for our clients. To attain this mission we listen to our clients;. Under normal market conditions, the fund will invest at least 80% of its net assets in fixed income securities of issuers located in developed market. The investment seeks high current income with the opportunity for capital appreciation. Under normal market conditions, the Advisor intends to provide exposure. Includes $3,M in assets for which Brandywine Global provides non-discretionary investment management services. Non-discretionary assets are reported on a. Publication Date: June Factsheet - BrandywineGLOBAL - Global Opportunities Bond Fund. This document provides the portfolio's objective, performance. An actively managed, global fixed income strategy that seeks to maximize total return through strategic investment in countries, currencies, and sectors. Performance charts for BrandywineGLOBAL - Global Opportunities Bond Fund - USD Hedged (GLOBX) including intraday, historical and comparison charts. BrandywineGLOBAL - Global Opportunities Bond Fund seeks total return consisting of income and capital appreciation by investing in debt and fixed-income. The investment seeks to maximize total return consisting of income and capital appreciation. The fund normally invests at least 80% of its net assets in fixed. Brandywine Global's mission is to deliver superior investment solutions and performance for our clients. To attain this mission we listen to our clients;.

GOBIX | A complete BrandywineGLOBAL - Global Opportunities Bond Fund;I mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and. Get BrandywineGLOBAL - Global Opportunities Bond Fund Class I (GOBIX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Legg Mason Global Asset Management Trust - BrandywineGLOBAL - Global Opportunities Bond Fund is an open ended fixed income mutual fund launched and managed. Get the latest BrandywineGLOBAL - Global Opportunities Bond Fund (GOBIX) price, news, buy or sell recommendation, and investing advice from Wall Street. The fund normally invests at least 80% of its net assets in fixed income securities of issuers located in developed market countries. BrandywineGLOBAL Global Opp Bond IS GOBSX ; NAV / 1-Day Return / + % ; Total Assets Bil ; Expense Ratio % ; Distribution Fee Level Below Average. FTGF Brandywine Global Credit Opportunities Fund · FTGF Brandywine Global Dynamic US Equity Fund · FTGF Brandywine Global Fixed Income Absolute Return Fund. Find the latest performance data chart, historical data and news for BrandywineGLOBAL - Global Opportunities Bond Fund Class IS (GOBSX) at intensa-promo.ru BRANDYWINEGLOBAL - GLOBAL OPPORTUNITIES BOND FUND CLASS I- Performance charts including intraday, historical charts and prices and keydata. GOBSX | A complete BrandywineGLOBAL - Global Opportunities Bond Fund;IS mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and. The WGBI currently comprises sovereign debt from multiple countries, denominated in a variety of currencies. The WGBI provides a broad benchmark for the global. Objective. The investment seeks to maximize total return consisting of income and capital appreciation. The fund normally invests at least 80% of its net assets. Get the latest BrandywineGLOBAL - Global Opportunities Bond Fund Class FI (GOBFX) real-time quote, historical performance, charts, and other financial. View the latest BrandywineGLOBAL - Global Opportunities Bond Fund;IS (GOBSX) stock price, news, historical charts, analyst ratings and financial information. Fund Details. Legal Name. BrandywineGLOBAL - Global Opportunities Bond Fund. Fund Family Name. FRANKLIN TEMPLETON. Inception Date. Apr 26, Shares. Morningstar Category: Global bond portfolios typically invest 40% or more of their assets in fixed-income instruments issued outside of the U.S. These. Fund, Investment Team. BG Corporate Credit Fund · Global Fixed Income · BG Flexible Bond Fund · Global Fixed Income · BG Global Opportunities Fund. View 13F filing holders of BrandywineGLOBAL - Global Opportunities Bond Fund-Class I. 13F filings are submitted quarterly to the SEC by hedge funds and. The fund normally invests at least 80% of its net assets in fixed income securities of issuers located in developed market countries. Complete BrandywineGLOBAL - Global Opportunities Bond Fund;I funds overview by Barron's. View the GOBIX funds market news.

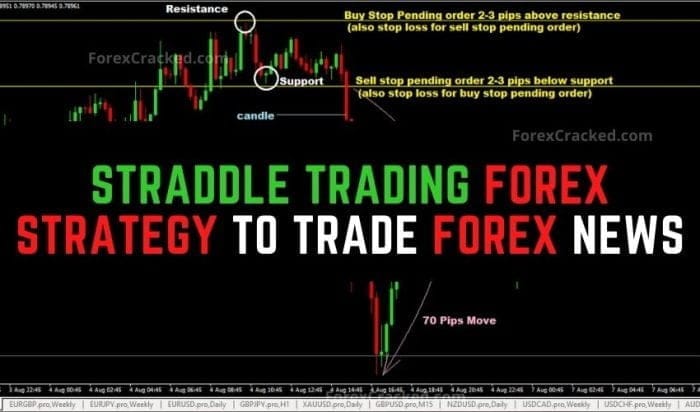

Straddle Trade Strategy

This is known as a straddle trade. You are looking to play BOTH sides of the trades. It doesn't matter which direction the price moves. A straddle is an options strategy that involves buying both a call and put option on the same underlying asset with the same strike price and expiration date. A straddle is an options trading strategy that uses both a call and a put option on the same asset, for example the underlying stock. So in essence, a long straddle is like placing a bet on the price action each-way – you make money if the market goes up or down. Hence the direction does not. A straddle is an options trading strategy where an investor purchases both a call option and a put option with the same strike price and expiration date. Long Straddle is an Options trading strategy that consists of buying an ATM call and an ATM put, where both contracts have the same underlying asset, strike. A long straddle is a multi-leg, risk-defined, neutral strategy with unlimited profit potential that traders can use when they anticipate volatility to rise. I trade straddles and the most important thing is buying them at the lowest cost possible. The value of the straddle will change a lot even at. Shrewd option traders execute transactions based on the volatility of the stock under option by buying a straddle. This trading strategy is primarily based on. This is known as a straddle trade. You are looking to play BOTH sides of the trades. It doesn't matter which direction the price moves. A straddle is an options strategy that involves buying both a call and put option on the same underlying asset with the same strike price and expiration date. A straddle is an options trading strategy that uses both a call and a put option on the same asset, for example the underlying stock. So in essence, a long straddle is like placing a bet on the price action each-way – you make money if the market goes up or down. Hence the direction does not. A straddle is an options trading strategy where an investor purchases both a call option and a put option with the same strike price and expiration date. Long Straddle is an Options trading strategy that consists of buying an ATM call and an ATM put, where both contracts have the same underlying asset, strike. A long straddle is a multi-leg, risk-defined, neutral strategy with unlimited profit potential that traders can use when they anticipate volatility to rise. I trade straddles and the most important thing is buying them at the lowest cost possible. The value of the straddle will change a lot even at. Shrewd option traders execute transactions based on the volatility of the stock under option by buying a straddle. This trading strategy is primarily based on.

A straddle is a neutral strategy in options trading that involve the simultaneously buying of a put and a call of the same underlying asset. It is basically a way for traders to take advantage of the changes in market volatility. In this blog, we will look at Straddle as an options strategy. What is. A long straddle is a seasoned option strategy where you buy a call and a put at the same strike price, allowing for profit if the stock moves in either. Short Straddle. Investors using the short straddle strategy anticipate that the underlying market/security of the options will trade in a narrow range and. Get to know the Options Straddle, a useful strategy when you are unsure which direction a stock is going to go, but you are expecting a big move. Long Straddle Option Strategy is just opposite Short Straddle and is a Volatility Strategy that aims to make money wherein you do expect underlying to show any. DEFINITION: A straddle is a trading strategy that involves options. To use a straddle, a trader buys/sells a Call option and a Put option simultaneously for. The straddle strategy gives you a seat at the table, no matter which side the coin lands on. It's a tool that transforms uncertainty into opportunity. A straddle is a price-neutral options strategy that involves the trading of call and put options for an asset, with the same strike price and expiration date. The trader will profit from the strategy only if the market or the underlying moves sharply before the expiry date. The move has to be greater than the cost of. A straddle is an options trading strategy that involves buying or selling both a call option and a put option with the same strike price and expiration date. Long straddles. A long straddle is a strategy consisting of the purchase of both a call and a put option with the same expiration date and strike price on. In trading, a straddle strategy involves buying and selling at the same time – it is direction neutral. To make this strategy work, the two positions selected. The long straddle option is simply the simultaneous purchase of a long call and a long put on the same underlying security with both options having the same. In finance, a straddle strategy involves two transactions in options on the same underlying, with opposite positions. One holds long risk, the other short. A long straddle is a seasoned option strategy where you buy a call and a put at the same strike price, allowing for profit if the stock moves in either. This strategy involves selling a call option and a put option with the same expiration and strike price. It generally profits if the stock price and volatility. A straddle is an options trading strategy where a trader simultaneously buys a call option and a put option with the same strike price and expiration date. At its core, a long straddle involves an investor buying equal quantities of call and put options with identical strike prices and expiration dates. Think of it.