intensa-promo.ru

Gainers & Losers

What Is Index Rate For Student Loans

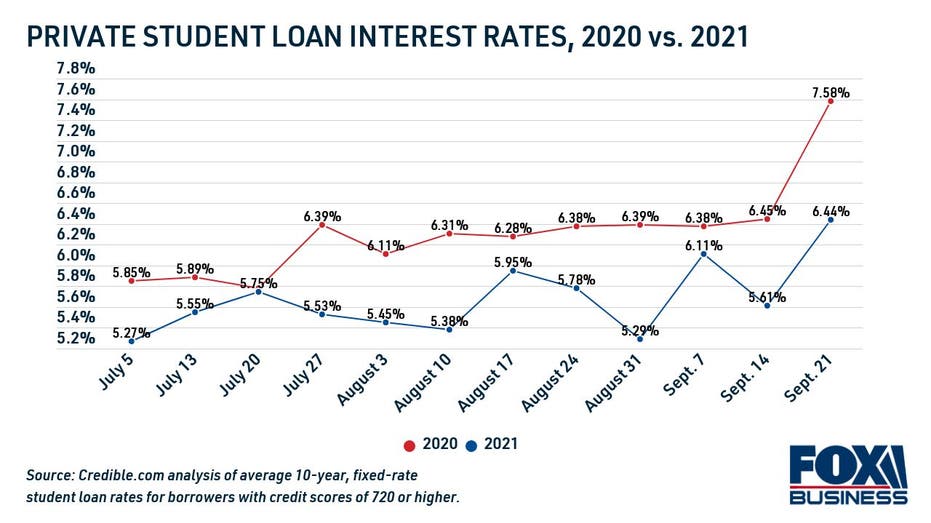

It's usually best to start with federal student loans, which have an interest rate of percent for undergraduate students for the school year. SELF Loan - Low-cost student loan - variable interest rate % through or fixed rate %. Available to Minnesota residents attending. The fixed interest rate for each federal loan type is set using a base rate, or index, plus an add-on or margin for each loan type. The latest year Treasury. This loan calculator assumes that the interest rate remains constant throughout the life of the loan. Currently the Undergraduate Federal Stafford. Also, variable interest rates are often expressed as the sum of a variable rate index and a fixed margin. The variable rate index is a reference rate that. =Borrower Rate, =Borrower Rate. Rate Index, year Adj. BND Net Rate, %. +, +. Lead Lender, Service Fee. =Borrower Rate, =Borrower Rate. Student Loans. An indexed rate is an interest rate that is tied to a specific benchmark with rate changes based on the movement of the benchmark. As of Sep 01, , the day average SOFR index is %. Variable interest rates will fluctuate over the term of the loan with changes in the SOFR index, and. A variable interest rate is an interest rate that may go up or down due to an increase or decrease to the loan's index. It's usually best to start with federal student loans, which have an interest rate of percent for undergraduate students for the school year. SELF Loan - Low-cost student loan - variable interest rate % through or fixed rate %. Available to Minnesota residents attending. The fixed interest rate for each federal loan type is set using a base rate, or index, plus an add-on or margin for each loan type. The latest year Treasury. This loan calculator assumes that the interest rate remains constant throughout the life of the loan. Currently the Undergraduate Federal Stafford. Also, variable interest rates are often expressed as the sum of a variable rate index and a fixed margin. The variable rate index is a reference rate that. =Borrower Rate, =Borrower Rate. Rate Index, year Adj. BND Net Rate, %. +, +. Lead Lender, Service Fee. =Borrower Rate, =Borrower Rate. Student Loans. An indexed rate is an interest rate that is tied to a specific benchmark with rate changes based on the movement of the benchmark. As of Sep 01, , the day average SOFR index is %. Variable interest rates will fluctuate over the term of the loan with changes in the SOFR index, and. A variable interest rate is an interest rate that may go up or down due to an increase or decrease to the loan's index.

The Federal Direct Unsubsidized Stafford Loan for graduate students carries a rate of the year index plus %. For loans that first disburse from July 1. Although the Federal Reserve Board will introduce a % increase in the Federal Funds rate when it begins increasing interest rates again, it will likely be. Once calculated it will be fixed for the life of that loan. Example: Effective 07/01/ the index rate is % + % = % and it will be fixed. Any new. An interest rate that remains the same for a set period of time, regardless of the changing underlying interest rate index. Advantages of a fixed interest rate. The Index: This is a benchmark interest rate that reflects general market conditions and can fluctuate based on economic factors. The Margin: This is a set. For now, a rate of LIBOR + % is roughly the same as PRIME + %. Generally, it is better to have an interest rate pegged to the LIBOR index, as such a rate. Once you get your first bill, you can find your monthly payment amount by logging in to your loan servicer's website. Don't worry—the interest rate is fixed for. A variable interest rate is typically determined by adding a fixed percent, or “margin” to a defined index rate. Some lenders use an index called the day. Indexation is added to your Higher Education Loan Program (HELP) debt each year. This means means the amount you repay in total will be more than the. The current 30 day average SOFR index rate is %. Changes in the 30 day average SOFR index rate may cause your monthly payment to increase or decrease. The interest rate is used to calculate the actual amount of interest that accrues on your student loan. For example, if your principal loan balance is $10, Private Student Loan 3-Month Constant Prepayment Rate (CPR) Index. About. About UsContactCareers. For the school year, the interest rate on Direct PLUS loans is %. But in June , some private student loan rates are actually lower. Also. Federal Loan Interest Rates by Year ; Year, Direct Subsidized, Direct Unsubsidized ; , %, % ; , %, % ; , %, %. As of Sep 01, , the day average SOFR index is %. Variable interest rates will fluctuate over the term of the loan with changes in the SOFR index, and. In contrast, a variable rate is an interest rate that may change periodically throughout the life of the loan. Variable interest rates are tied to an index. If. Rates on year fixed-rate student loans averaged %, up from % last week and down from % a year ago. Rates hit a record low of % on Dec. · Rates. Once you get your first bill, you can find your monthly payment amount by logging in to your loan servicer's website. Don't worry—the interest rate is fixed for. The variable interest rate for each calendar month is calculated by adding the Day Average Secured Overnight Financing Rate (“SOFR”) index, or a replacement. Compare student loan fixed interest rates from % and variable interest rates from % APR ¹ without affecting your credit score. It only takes.

Great Stock To Invest In

Best stock for beginners · Broadcom (AVGO) · JPMorgan Chase (JPM) · UnitedHealth (UNH) · Comcast (CMCSA) · Bristol-Myers Squibb Co. (BMY). One example of investors investing emotionally was during the "dot-com" boom, when many investors threw caution to the wind and leaped into internet stocks. 7 best stocks to buy now, according to analysts ; Zoetis Inc. ; intensa-promo.ru Inc. ; Uber Technologies Inc. ; Microsoft Corporation. Very good app. I like just about everything about it - ESPECIALLY for one thing and EXCEPT for one thing. I especially like the fact you can. Creating an investment portfolio is one simple⎯ and practical⎯ option to help grow your funds. So, which types of investments are best for you: Stocks vs Bonds? Value investing, or the Warren Buffett strategy, is one of the most consistent strategies for maximizing long-term returns. It involves buying stocks that have. 7 Great Stocks To Buy and Hold · #1) Enterprise Products Partners (EPD) · #2) Brookfield Corporation (BN) · #3) MicroStrategy (MSTR) · #4) HDFC Bank (HDB) · #5). Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Blue chip stocks. Blue chip stocks are those that have the strongest resources and operate in the best industries. · Companies with growing sales and profits. Best stock for beginners · Broadcom (AVGO) · JPMorgan Chase (JPM) · UnitedHealth (UNH) · Comcast (CMCSA) · Bristol-Myers Squibb Co. (BMY). One example of investors investing emotionally was during the "dot-com" boom, when many investors threw caution to the wind and leaped into internet stocks. 7 best stocks to buy now, according to analysts ; Zoetis Inc. ; intensa-promo.ru Inc. ; Uber Technologies Inc. ; Microsoft Corporation. Very good app. I like just about everything about it - ESPECIALLY for one thing and EXCEPT for one thing. I especially like the fact you can. Creating an investment portfolio is one simple⎯ and practical⎯ option to help grow your funds. So, which types of investments are best for you: Stocks vs Bonds? Value investing, or the Warren Buffett strategy, is one of the most consistent strategies for maximizing long-term returns. It involves buying stocks that have. 7 Great Stocks To Buy and Hold · #1) Enterprise Products Partners (EPD) · #2) Brookfield Corporation (BN) · #3) MicroStrategy (MSTR) · #4) HDFC Bank (HDB) · #5). Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Blue chip stocks. Blue chip stocks are those that have the strongest resources and operate in the best industries. · Companies with growing sales and profits.

Potential Benefits Of Investing In Stocks · Potential capital gains from owning a stock that grows in value over time · Potential income from dividends paid by. Sometimes value investing is described as investing in great companies at a good price, not simply buying cheap stocks. Screening for growth or value. Schwab. The most effective way to invest in the stock market is through index funds. Gaining knowledge to grow and intelligently invest your money is a great. 5 Best Stock Research Websites · 1. intensa-promo.ru · 2. AlphaResearch · 3. Finsheet · 4. SeekingAlpha · 5. intensa-promo.rue. The 10 best long-term investments · 1. Growth stocks · 2. Stock funds · 3. Bond funds · 4. Dividend stocks · 5. Value stocks · 6. Target-date funds · 7. Real estate · 8. Coca-Cola has become one of the best-performing stocks of all time because the company has developed a number of competitive advantages. The brand in itself has. Join the millions of people using the intensa-promo.ru app every day to stay on top of the stock market and global financial markets! How you can choose the best stocks to buy ; Coca-Cola · Consumer staples · $ billion ; Cadence Design Systems · Technology · $ billion ; Thermo Fisher. Stocks offer investors the greatest potential for growth (capital appreciation) over the long haul. Stock funds are another way to buy stocks. These are a. The Motley Fool has been providing investing insights and financial advice to millions of people for over 25 years. Learn how we make the world Smarter. Income-oriented investors focus on buying (and holding) stocks in companies that pay good dividends regularly. These tend to be solid but low-growth companies. Stocks ; T AT&T Inc. + (+%). + ; F Ford Motor Company. (%). ; BAC Bank of America Corporation. (%). -. The case for investing in stocks Equities can add diversification and serve as a growth engine to help build value over time: Higher growth potential —. Investing in tech stocks: Is now a good time? Technology stocks, drivers of equity market performance in and much of , underperformed other parts of. The answer is: we don't know, but it's not looking good. 2 - Which company stands to benefit from an antitrust probe in the AI accelerator space? A - Is it. It is always a good idea to look for stocks that are set up for outperformance in the near future. 3 min read. View More. Ideas From Columnists. Favorites from. When you buy a stock, you're buying part ownership of a company and an The good news is that you can find most of the answers to these questions in. Pick the best stocks to buy and optimize your portfolio with the power of our AI. Get unbiased and unique insights, and make smart data-driven investment. Dow Jones Drug Giant Merck, Nvidia Eye Buy Points In Current Stock Market Dow Jones drug giant Merck and Nvidia stock are among the best stocks to buy and. Learn about stock investing and get our take on timely company news and the stock market Best Companies to Invest in Now. Margaret Giles Sep 3, Sectors.

Invest Cd Calculator

Use our free calculator to see how much money you'll earn with a TDECU Certificate of Deposit (CD). Find the right term and interest rate for your TDECU CD. How much interest will you earn on a Certificate of Deposit (CD) Investments and Retirement · Estate Planning Guidance · College and Career. You input the principal amount, the interest rate (or APY), and the term length of the CD. The calculator then computes the total interest accrued over the CD's. How much you wish to invest in each CD in your ladder. The tool uses this amount to calculate the number of CDs in the ladder. If the amount that you enter isn'. Use Shore United Bank's CD Calculator to find out how much interest you can earn on a Certificate of Deposit (CD). Build a strong savings plan online. Certificate of Deposit Calculator. Routing Number: Schedule an Appointment. Set a time to meet with a Veridian expert. Use the CD calculator to see how much interest you could earn with a Marcus CD at various deposit amounts and term lengths. Estimated Value · Initial Balance or Deposit. This field is invalid. · Term of CD in Months. Valid values are from 1 to · Annual Interest Rate. Valid values. You can keep your money securely set aside and earn interest with a Certificate of Deposit (CD). calculator provides investment-related calculations, actual. Use our free calculator to see how much money you'll earn with a TDECU Certificate of Deposit (CD). Find the right term and interest rate for your TDECU CD. How much interest will you earn on a Certificate of Deposit (CD) Investments and Retirement · Estate Planning Guidance · College and Career. You input the principal amount, the interest rate (or APY), and the term length of the CD. The calculator then computes the total interest accrued over the CD's. How much you wish to invest in each CD in your ladder. The tool uses this amount to calculate the number of CDs in the ladder. If the amount that you enter isn'. Use Shore United Bank's CD Calculator to find out how much interest you can earn on a Certificate of Deposit (CD). Build a strong savings plan online. Certificate of Deposit Calculator. Routing Number: Schedule an Appointment. Set a time to meet with a Veridian expert. Use the CD calculator to see how much interest you could earn with a Marcus CD at various deposit amounts and term lengths. Estimated Value · Initial Balance or Deposit. This field is invalid. · Term of CD in Months. Valid values are from 1 to · Annual Interest Rate. Valid values. You can keep your money securely set aside and earn interest with a Certificate of Deposit (CD). calculator provides investment-related calculations, actual.

Use this calculator to examine the benefits of investing in a series of Certificates of Deposits with different maturities, also called a CD Ladder. The interest earned on your CD is added to your CD balance at regular intervals. This is called "compounding." This calculator allows you to choose the. This calculator allows you to choose the frequency that your CD's interest income is compounded. The more frequently this occurs, the sooner your accumulated. Use this calculator to find out how much interest you can earn on a Certificate of Deposit (CD). Just enter a few pieces of information and the tool will. This calculator will help you build a CD ladder that's right for you. Compare CD rates and start building your CD ladder today. Deposit amount: Minimum CD term. Use this calculator to examine the benefits of investing in a series of Certificates of Deposit with different maturities, also called a CD Ladder. To the extent the calculator provides investment-related calculations, actual returns and principals values will vary. We're happy to discuss much more than. Certificate of Deposit Calculator Use this calculator to find out how much interest you can earn on a certificate of deposit (CD). Just enter a few pieces of. Manage cash flow, mitigate risk, and strategically invest with business banking solutions encompassing both traditional commercial banking and alternative. CDs in your Ladder. The number of CDs that will be in your CD ladder. Each CD will have a different maturity date, so that one of your CDs will mature at the. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Quontic Bank — 6 months. The interest and APY earned amount is based on the advertised APY, and assumes that for the entire investment period, that the principal and interest remain on. UniBank's Certificate of Deposit (CD) Calculator helps you quickly and easily determine your Annual Percentage Yield and ending balance. Get started now. Maximize your savings with our CD calculator. Calculate your potential compound interest and see the growth impact on your initial investment. Starting with $10, at % interest results in $10, x = $ interest for a final sum at the end of year one of $10, In year two the calculation. CD laddering is an investment strategy that allows you to take advantage of the higher interest rates that typically come with longer CDs terms, without locking. By accurately calculating the Annual Percentage Yield (APY) and interest rates associated with your CD investment, this free CD calculator simplifies the. Certificate of Deposit (CD) Calculator. Calculate to find out how much interest can be earned on Certificate of Deposits (CDs). By using this resource. CDs are considered low-risk investments with lower returns than many other investment options. While historically, CD interest rates have been higher than. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment.

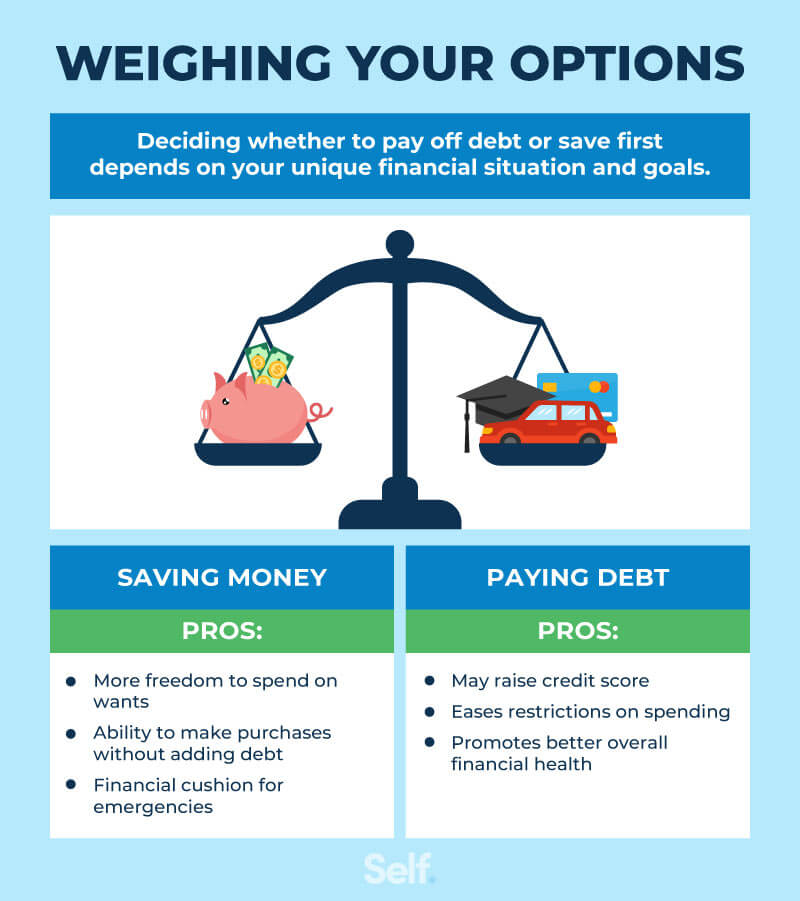

Should I Pay Off Debt Before Investing

Very rarely should you sell your investments to pay off debt. The one exception here is if you have high-interest debt (like an outstanding credit card balance). Being debt free is obviously desirable, but if you expect to earn a higher rate of return on the investment than you are paying in interest on the loan, it may. As a general rule, if you can earn more interest on your money by investing it than your debts are costing you, then it makes sense to invest. Also, remember that credit cards and personal loans commonly come with high interest rates. If you have debt from either, it's best to focus on paying that off. There is a longstanding financial maxim that if people come into money – or are holding cash reserves – they should pay off their debts first, rather than. off eliminating all credit card debt before investing If you've got unpaid balances on several credit cards, you should first pay down the card that charges. If it is high cost debt, say over 7% than paying off the debt will give you a greater return on your money than leaving it invested at an. Financial planners often recommend most people pay off loans first, but in some situations, investing money is a better choice. Deciding whether to invest or pay off debt can be a hard decision. Learn paying down debt strategies and other factors to consider. Very rarely should you sell your investments to pay off debt. The one exception here is if you have high-interest debt (like an outstanding credit card balance). Being debt free is obviously desirable, but if you expect to earn a higher rate of return on the investment than you are paying in interest on the loan, it may. As a general rule, if you can earn more interest on your money by investing it than your debts are costing you, then it makes sense to invest. Also, remember that credit cards and personal loans commonly come with high interest rates. If you have debt from either, it's best to focus on paying that off. There is a longstanding financial maxim that if people come into money – or are holding cash reserves – they should pay off their debts first, rather than. off eliminating all credit card debt before investing If you've got unpaid balances on several credit cards, you should first pay down the card that charges. If it is high cost debt, say over 7% than paying off the debt will give you a greater return on your money than leaving it invested at an. Financial planners often recommend most people pay off loans first, but in some situations, investing money is a better choice. Deciding whether to invest or pay off debt can be a hard decision. Learn paying down debt strategies and other factors to consider.

No. I live with minimal credit card debt, but I have a mortgage, a car loan, and one last student loan. I focus hard on eliminating and minimizing credit card. During the time you make debt payments, you sacrifice interest income that you could have earned if you had invested the same amount. However, once you pay off. Get your immediate finances in order before you invest. Pay off any short-term debt, have an emergency cash fund and consider investing more in your. Generally, building an emergency fund should be your priority. However, your personal financial situation will dictate when you should pay off debt. Paying off debt means you'll have more money available to put toward other financial goals, such as investing, adding to your emergency fund, or saving for. Should you use your extra money to pay down debt or put into an investment? Generally, it's advisable to invest only if the return on investment would exceed. Making more than your required minimum payment can help you pay off debts more quickly and save money in interest charges. Earmark unanticipated funds, such as. As a general rule, it's usually better to consider paying off your debts before you start investing – especially if they're high-interest debts. While investing may offer growth potential and long-term financial security, paying off debt provides immediate relief and reduces financial vulnerability. If your rate of return would be lower than your interest rate on the debt, then it makes sense to pay down debt. For example, say you have a loan with a 7%. Those interest rates are likely much higher than you would get by investing the money. Making a plan to pay off that high debt as quickly as possible gives you. In general, it is mostly best to pay down debt before investing. The risk of investments is usually greater than the risk of paying debt. If your debt is student loan debt, and your interest rates are less than 6%, putting extra money in your investment account could be a better bet. Over the long. No matter what other financial priorities you have, always be sure to make at least the minimum payments on all debt, on time. · Your next step should generally. Saving allows you to generate a nest egg, while paying off your debt helps you save money on the interest you pay. Mindset comes into play here. Carrying heavy debt can be emotionally difficult. If you're losing sleep over your debts, then you could be better off repaying. So plan to pay off your debts before you start to save. Make sure you understand what interest you're paying on your different loans, so you know which ones you. If the interest rate of the loan is exceeding your investment and savings vehicles, that could be a situation where it makes more sense to focus on paying off. Yes! Debt is an important tool to help you achieve financial success. Tune in to this week's episode to find out exactly when you should pay off debt. You need to catch up on retirement savings: · Your cash reserves are low: · You carry higher-interest debt: · You might miss out on investment returns.

What Is Ios For Iphone

:max_bytes(150000):strip_icc()/ios-14-9f6e598c28e3478a9e680bb0fe3fde7e.jpg)

iOS is a mobile operating system developed by Apple Inc. and was first released as iPhone OS in June , coinciding with the launch of the first. You can ask as nicely as you want, but an iPhone 6s cannot and will not ever be able to update to iOS 16 or anything higher. If you need a higher level iOS. iOS 18 makes iPhone even more personal, with deeper customization, new ways to connect, easier-to-find photos, and support for Apple Intelligence. I have tried hard to fix performance issues with my iPhone 11 after the update to IOS 17 but even after going though the various factory resets it's remains a. iOS 11 brings hundreds of new features to iPhone and iPad including an all new App Store, a more proactive and intelligent Siri, improvements to Camera and. Apple Event September 12, Introducing iPhone 15 Pro, iPhone 15, Apple Watch Series 9, Apple Watch Ultra 2, and a major step toward making all our products. The operating system for Apple's iPhone, iPad, and other Apple mobile devices is referred to as iOS. It's an acronym for iPhone Operating System. iOS 15 brings audio and video enhancements to FaceTime, including spatial audio and Portrait mode. Shared with You resurfaces the articles, photos. These tables show the first and maximum version of iOS or iPadOS for each iPhone, iPad, and iPod touch. Only major versions (eg iOS 13) are shown. iOS is a mobile operating system developed by Apple Inc. and was first released as iPhone OS in June , coinciding with the launch of the first. You can ask as nicely as you want, but an iPhone 6s cannot and will not ever be able to update to iOS 16 or anything higher. If you need a higher level iOS. iOS 18 makes iPhone even more personal, with deeper customization, new ways to connect, easier-to-find photos, and support for Apple Intelligence. I have tried hard to fix performance issues with my iPhone 11 after the update to IOS 17 but even after going though the various factory resets it's remains a. iOS 11 brings hundreds of new features to iPhone and iPad including an all new App Store, a more proactive and intelligent Siri, improvements to Camera and. Apple Event September 12, Introducing iPhone 15 Pro, iPhone 15, Apple Watch Series 9, Apple Watch Ultra 2, and a major step toward making all our products. The operating system for Apple's iPhone, iPad, and other Apple mobile devices is referred to as iOS. It's an acronym for iPhone Operating System. iOS 15 brings audio and video enhancements to FaceTime, including spatial audio and Portrait mode. Shared with You resurfaces the articles, photos. These tables show the first and maximum version of iOS or iPadOS for each iPhone, iPad, and iPod touch. Only major versions (eg iOS 13) are shown.

The max supported iOS version for each Apple iPhone, iPad and iPod touch. Complete and partial support for iOS 18/iPadOS 18 and earlier. The Duo Mobile application makes it easy to authenticate — just tap “Approve” on the login request sent to your iPhone. The iPhone 7 doesn't have the hardware necessary to run iOS If you require iOS you will need a newer model iPhone. You may update your iPhone 7 to iOS The iPhone 8 cannot update to iOS 17, but it can update to iOS To do that, go to settings>general>software update and make sure to connect to a wifi. iOS stands for “iPhone Operating System.” It is the operating system software that runs on Apple's iPhone and iPad devices. It is similar to the software that. This guide helps you get started using iPhone and discover all the amazing things it can do with iOS , which is compatible with the following models. The iPhone 7 doesn't have the hardware necessary to run iOS If you require iOS you will need a newer model iPhone. You may update your iPhone 7 to iOS 1. Open the Settings app on your iPhone (you can pull down on the home screen and search for “Settings”). 2. Scroll down till you see. Protect your iOS device from spam calls, annoying ads, suspicious texts, and malicious websites. Make your iOS experience safer and faster while getting rid. This guide helps you get started using iPhone and discover all the amazing things it can do with iOS , which is compatible with the following models. iOS is Apple's mobile operating system that powers the iPhone and iPod Touch. Until , it was also the operating system used by the iPad (which we'll discuss. iOS 17 brings big updates to Phone, Messages, and FaceTime that give you new ways to express yourself as you communicate. StandBy delivers a new full-screen. Everything about iOS is designed to be easy. That includes switching to it. With just a few steps, you can migrate your content automatically and securely. Add your intensa-promo.ru, Microsoft , or Exchange-based email account to your iPhone, iPad, or iPod Touch using Outlook for iOS. Using the Zoom mobile app on iOS, you can join meetings, schedule your own meetings, chat with contacts, and view a directory of contacts. iOS 15 brings audio and video enhancements to FaceTime, including spatial audio and Portrait mode. Shared with You resurfaces the articles, photos. iOS is the Operating system for iPhones made by Apple. It was first called “iPhone OS” for the first 3 years () later on in the Operating system. Powerful. Beautiful. Durable. Check out the new iPhone 15 Pro, iPhone 15 Pro Max, iPhone 15, and iPhone 15 Plus. Apple has officially announced iOS 18 – here's everything we know about the upcoming iPhone update. iOS 16 brings a redesigned Lock Screen with new ways to customize and widgets for information at a glance. Link your Lock Screen to a Focus and use Focus.

Money After Retirement

The Social Security retirement benefit is a monthly check that replaces part of your income when you reduce your hours or stop working altogether. practical considerations in mind: 1. If you are withdrawing money from tax-deferred retirement accounts, you will owe income taxes on the withdrawal. Set a. Pensions and some retirement packages may offer you a choice: Take a lump-sum payout or begin monthly payments immediately, or, if you retire early, delay those. Upon retirement, you have the option to leave your money in your (k), transfer it to an IRA, withdraw a lump sum, convert it into an annuity. Tips for Saving Money When You're Retired · Use Senior Discounts: · Be Aware of Scams · Be Smart About Investing · Shop Online for Better Deals: · Create a. To live well in retirement, you can no longer rely solely on a company pension plan or Social Security. Instead, you will have to depend on how skillfully. Managing retirement income starts with knowing what your sources of income will be—from Social Security to an employer-sponsored retirement savings account. Cash-balance plans are a type of defined benefit, or pension plan, too. But instead of replacing a certain percentage of your income for life, you are promised. Are you saving enough for retirement? SmartAsset's award-winning calculator can help you determine exactly how much you need to save to retire. The Social Security retirement benefit is a monthly check that replaces part of your income when you reduce your hours or stop working altogether. practical considerations in mind: 1. If you are withdrawing money from tax-deferred retirement accounts, you will owe income taxes on the withdrawal. Set a. Pensions and some retirement packages may offer you a choice: Take a lump-sum payout or begin monthly payments immediately, or, if you retire early, delay those. Upon retirement, you have the option to leave your money in your (k), transfer it to an IRA, withdraw a lump sum, convert it into an annuity. Tips for Saving Money When You're Retired · Use Senior Discounts: · Be Aware of Scams · Be Smart About Investing · Shop Online for Better Deals: · Create a. To live well in retirement, you can no longer rely solely on a company pension plan or Social Security. Instead, you will have to depend on how skillfully. Managing retirement income starts with knowing what your sources of income will be—from Social Security to an employer-sponsored retirement savings account. Cash-balance plans are a type of defined benefit, or pension plan, too. But instead of replacing a certain percentage of your income for life, you are promised. Are you saving enough for retirement? SmartAsset's award-winning calculator can help you determine exactly how much you need to save to retire.

And don't forget about other sources of income that may be available to you many years from now, including the money in your workplace and personal retirement. After retirement, Social Security provides you with some income to help you pay for your living expenses. The exact amount of Social Security income you. For some, it may be about the money. Four in 10 workers and three in 10 retirees worry that their money won't keep up with inflation in retirement — collecting. Pros: May help you get money from the equity in your home to use towards a new home or to boost your retirement income · Cons: Locks you into a property when you. Keep your retirement finances strong, and understand the factors for building a retirement income strategy (with RMDs), to enjoy what you've worked so hard. 27 Tips for Saving Money After Retirement · 1. Get out of retirement · 2. Delay drawing Social Security · 3. Consider a reverse mortgage · 4. Downsize · 5. 1. Estimate your retirement savings and income needs · 2. Stay relevant in the employment market · 3. Write out your retirement strategy · 4. Catch up on your. Here are four ways to help make managing your finances easier in retirement. · 1. Manage your retirement income. To start, consider the ways that retirement can. Continuing to work after retiring can help you pay for essential expenses such as housing, food, utilities and health care without using retirement savings. In general, it's a good idea to hold this portion in cash or cash equivalents—for example, high-yield checking or savings accounts, money market funds, short-. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at One common rule of thumb suggests that people subtract their age from to determine a percentage of their money to keep in stocks. Following that guideline. An income annuity is a contract between you and an insurance company where you pay a sum of money, either all at once or monthly, in exchange for regular income. Chronic overspending. There are certain threats to outliving your assets, which both Grist and Williams called “leakage.” Often, these leaks are in areas that. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be. ▫ The average American spends roughly 20 years in retirement. Putting money away for retirement is a habit we can all live with. Remember Saving Matters! 1. The bottom-line goal of retirement planning is deceptively simple: accumulating enough money to live the life you want once your career is no longer occupying. The same principle holds true for taking income in retirement: Creating an income plan that includes money from different sources can help you cover the. As with all retirement planning, the exact answer will vary from person to person. However, experts generally recommend withdrawing no more than 4% to 5% of. Investing in retirement · 1. Calculate the approximate amount you'll need each year. Start by calculating your expenses and your expected income from other.

Best App To Learn How To Trade Stocks

:max_bytes(150000):strip_icc()/androidstocks-investing-5bda87e446e0fb002d4a7662.jpg)

Our exhaustive research has found that E*TRADE is our overall pick for best investment and trading app because of how it optimizes its mobile platforms to. You will be surprised to know that the commission-free popular trading app, Robinhood is gaining users since , although the app was officially launched in. Top 10 Best Trading Apps · Charles Schwab · WeBull · Fidelity · Ally Invest · RobinHood · E*Trade · MerrillEdge · Coinbase. Acorns. Sofi. The. Best choice of trading instruments · CAPEX powerful dual platforms · Overview of CFD stock trading mobile apps and the global market · Get Started with CAPEX. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Best Mobile Trading Apps For Stocks ; eToro Mobile App: Features and Advantages. Market-leading Copy Trading service – ideal for those looking to leverage off. Look no further than Learn by MyWallSt - the ultimate guide for beginner investors, trusted by over 8 million users worldwide. Dive into the stock market with. When you invest with AJ Bell you'll have access to thousands of different stocks, ETFs, and funds, making it a great choice if you wish to diversify your. Ready to embark on your investing journey? Learn Stocks. Learn by MyWallSt teaches you how to invest in the U.S stock market (Nasdaq) with easy to. Our exhaustive research has found that E*TRADE is our overall pick for best investment and trading app because of how it optimizes its mobile platforms to. You will be surprised to know that the commission-free popular trading app, Robinhood is gaining users since , although the app was officially launched in. Top 10 Best Trading Apps · Charles Schwab · WeBull · Fidelity · Ally Invest · RobinHood · E*Trade · MerrillEdge · Coinbase. Acorns. Sofi. The. Best choice of trading instruments · CAPEX powerful dual platforms · Overview of CFD stock trading mobile apps and the global market · Get Started with CAPEX. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Best Mobile Trading Apps For Stocks ; eToro Mobile App: Features and Advantages. Market-leading Copy Trading service – ideal for those looking to leverage off. Look no further than Learn by MyWallSt - the ultimate guide for beginner investors, trusted by over 8 million users worldwide. Dive into the stock market with. When you invest with AJ Bell you'll have access to thousands of different stocks, ETFs, and funds, making it a great choice if you wish to diversify your. Ready to embark on your investing journey? Learn Stocks. Learn by MyWallSt teaches you how to invest in the U.S stock market (Nasdaq) with easy to.

Best investing app for active trading: Robinhood Founded in with the goal of making investing more accessible and affordable for everyone, Robinhood. Bloom has helped me start up my investing portfolio and has even hooked me up with a little bit of $ in stocks to start me off. I love how this app has. Bloom has helped me start up my investing portfolio and has even hooked me up with a little bit of $ in stocks to start me off. I love how this app has. Incite AI breaks away from the norm of investment tools by being the best stock trading app. The technology helps with steep learning curves by offering a user. Some popular options include Zerodha's "Varsity," Moneycontrol's "Learn App," and StockEdge. These apps provide educational content, tutorials. Paytm Money is India's best overall trading application as they provide lot of monetary benefits. Aside from that, the app has an easy-to-use interface and. Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. 1. eToro – Best Overall. image showing eToro Trading Platform and its features. eToro's Copy. Best Forex Trading App for Beginners · 1. eToro — Best Forex Trading App for Beginners (Overall) · 2. FXTM – Best Forex Trading App for Beginners · 3. NetDania. StockDaddy is one of India's leading stock market app that helps you in your financial journey to make your future secure. It is not just a app for learning. Stash. Best investing app for beginners who: Want to get started buying stocks and could use some guidance. Stash combines a robo-advisor and self. What Is The Best Trading App For Beginners? For beginner traders, it's important to choose a platform that is easy to use and offers a wide range of. LearnApp offers online stock market courses by industry experts with decades of experience. Kickstart your trading & investing journey with LearnApp. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. LearnApp offers online stock market courses by industry experts with decades of experience. Kickstart your trading & investing journey with LearnApp. A new generation, world-renowned social trading app, eToro is a one-stop destination for those who'd like to learn more about trading. eToro enriched its modern. Go to your app store on your phone · Search for “Street Smart” and download the app · Open the Street Smart app. Master stock trading for financial success. Learn to analyze markets, execute trades, and manage risks. Explore the. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. If you're looking for the best stock trading app for research and education purposes, then there is no better option than TradingView. It offers tons of.

1 Bit Coin In Usd

Bitcoin's price today is US$59,, with a hour trading volume of $ B. BTC is +% in the last 24 hours. It is currently % from its 7-day all-. This is a change of % from yesterday and % from one year ago. Report, CoinGecko Cryptocurrency Prices. Category, Cryptocurrency. Region, N/A. The live Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our BTC to USD price in real-time. This graph shows the conversion rate of 1 Bitcoin to 1 USD at the first of each month. Bitcoin Historical Prices ($). 1 USD = BTC Sep 05, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Virtual currency / USD charts · Ethereum. ETH/USD. %. 2, USD · Bitcoin Cash. BCH/USD. %. USD · Polkadot. DOT/USD. %. USD. 1 BTC equals 56, USD. The current value of 1 Bitcoin is % against the exchange rate to USD in the last 24 hours. The current Bitcoin market cap. The trading volume of Bitcoin (BTC) is $28,,, in the last 24 hours, representing a % decrease from one day ago and. Bitcoin Price (BTC USD): Get all information on the Bitcoin to US-Dollar Exchange Rate including Charts, News and Realtime Price. Bitcoin's price today is US$59,, with a hour trading volume of $ B. BTC is +% in the last 24 hours. It is currently % from its 7-day all-. This is a change of % from yesterday and % from one year ago. Report, CoinGecko Cryptocurrency Prices. Category, Cryptocurrency. Region, N/A. The live Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our BTC to USD price in real-time. This graph shows the conversion rate of 1 Bitcoin to 1 USD at the first of each month. Bitcoin Historical Prices ($). 1 USD = BTC Sep 05, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Virtual currency / USD charts · Ethereum. ETH/USD. %. 2, USD · Bitcoin Cash. BCH/USD. %. USD · Polkadot. DOT/USD. %. USD. 1 BTC equals 56, USD. The current value of 1 Bitcoin is % against the exchange rate to USD in the last 24 hours. The current Bitcoin market cap. The trading volume of Bitcoin (BTC) is $28,,, in the last 24 hours, representing a % decrease from one day ago and. Bitcoin Price (BTC USD): Get all information on the Bitcoin to US-Dollar Exchange Rate including Charts, News and Realtime Price.

Get the latest price, news, live charts, and market trends about Bitcoin. The current price of Bitcoin in United States is $ per (BTC / USD). 1 BTC = 55, USD Sep 05, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use. Updated spot exchange rate of Bitcoin (XBT) against the US dollar index p a a a a p k k k k. Therefore, the price could vary from one platform to another, and it's important to check it on the place where you decide to trade virtual currency. For. The current price of Bitcoin (BTC) is 56, USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what coins. Get the latest 1 Bitcoin to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about Bitcoins and. The live price of Bitcoin is $ 56, per (BTC / USD) with a current market cap of $ 1,B USD. hour trading volume is $ B USD. BTC to USD price. Virtual currency / USD charts · Ethereum. ETH/USD. %. 2, USD · Bitcoin Cash. BCH/USD. %. USD · Polkadot. DOT/USD. %. USD. Convert Bitcoin to US Dollar (BTC to USD) ; Amount, Today at ; USD, Bitcoin ; 1 USD, Bitcoin ; 10 USD, Bitcoin ; 50 USD. Convert Bitcoin to US Dollar (BTC to USD) The price of converting 1 Bitcoin (BTC) to USD is $56, today. BTC-USD - Bitcoin USD ; Open, 56, ; Day's Range, 55, - 56, ; 52 Week Range, 24, - 73, ; Start Date, ; Algorithm, N/A. Popular Bitcoin (BTC) Pairings ; usd. US Dollar. 1 BTC equals to. 57, USD. (%) ; eur. Euro. 1 BTC equals to. 52, EUR. (%). 1 Month. %. 3 Month. %. YTD. %. 1 Year. %. Currency Converter. Amount: From: Argentinian Peso, Australian Dollar, Bahrainian Dinar. One of the defining characteristics of Bitcoin is its volatility. Its value fluctuates wildly, primarily driven by market demand. While this volatility has. BTC-USD - Bitcoin USD ; Market Cap, T ; Circulating Supply, M ; Max Supply, N/A ; Volume, 31,,, ; Volume (24hr), B. BTC to USD Conversion Table · 1 Bitcoin, United States Dollar · 2 Bitcoin, United States Dollar · 3 Bitcoin. Get the latest Bitcoin (BTC / USD) real-time quote, historical performance intensa-promo.ru Bitcoin Touches One-Month Low as Glum Traders Hedge for Payrolls. BTCUSD Bitcoin US DollarCurrency Exchange Rate Live Price Chart ; BTCUSD, , , % ; ETHUSD, 2,, , %. BTC to USD Conversion Table · 1 Bitcoin, United States Dollar · 2 Bitcoin, United States Dollar · 3 Bitcoin.

Best Crypto Wallet Fees

Coinbase, a leading cryptocurrency exchange, has a tiered fee system. If you are in 50k to k tier, Maker Fees stand at %, and Taker Fees at %. The Simplify Bitcoin Strategy PLUS Income ETF has total annual fund operating expenses of % with other costs, primarily composed of interest expense. In most cases, you'll pay relevant blockchain gas fees on trades and transactions. Most cryptocurrency wallets do not charge separate fees. The Coinbase exchange offers one of the most secure wallets to store digital assets. Coinbase wallet allows users to interact with Ethereum DApps via its. We've done the research with a roundup of crypto exchanges in Spain known for security, low fees, and features. Moreover, the platform offers Trust Wallet. Delivered quickly to any wallet, no hidden fees or third-party custody. Buy online or in the BitPay app. 1. Choose your crypto. Select from the top. intensa-promo.ru vs. Coinbase: Fees ; Wallet Conversion Fee, Free, 1% ; Debit/Credit Cards, %, N/A ; ACH Transfer, Free, with a minimum of $20, Free ; Wire Transfer. Bitcoin Average Transaction Fee is at a current level of , down from yesterday and down from one year ago. This is a change of %. There are a few different cryptocurrency wallets that charge lower transaction fees than others. For example, the Exodus wallet charges only. Coinbase, a leading cryptocurrency exchange, has a tiered fee system. If you are in 50k to k tier, Maker Fees stand at %, and Taker Fees at %. The Simplify Bitcoin Strategy PLUS Income ETF has total annual fund operating expenses of % with other costs, primarily composed of interest expense. In most cases, you'll pay relevant blockchain gas fees on trades and transactions. Most cryptocurrency wallets do not charge separate fees. The Coinbase exchange offers one of the most secure wallets to store digital assets. Coinbase wallet allows users to interact with Ethereum DApps via its. We've done the research with a roundup of crypto exchanges in Spain known for security, low fees, and features. Moreover, the platform offers Trust Wallet. Delivered quickly to any wallet, no hidden fees or third-party custody. Buy online or in the BitPay app. 1. Choose your crypto. Select from the top. intensa-promo.ru vs. Coinbase: Fees ; Wallet Conversion Fee, Free, 1% ; Debit/Credit Cards, %, N/A ; ACH Transfer, Free, with a minimum of $20, Free ; Wire Transfer. Bitcoin Average Transaction Fee is at a current level of , down from yesterday and down from one year ago. This is a change of %. There are a few different cryptocurrency wallets that charge lower transaction fees than others. For example, the Exodus wallet charges only.

Although software wallets are typically free, hardware wallets cost between $ and $ What is a mobile crypto wallet? Mobile wallets are the same as. #. Protection of your savings. NC Wallet is a wallet that goes beyond standard security and safety measures. · No commissions and transaction fees. Send. Compare the best Bitcoin exchanges that fees on the CoinJar Exchange. Among their products you can find a crypto wallet, exchange, and credit card. Buy and swap cryptocurrencies with the best Crypto Wallet & Bitcoin Wallet. Secure crypto, access all of Web3 with the multichain Exodus Web3 Wallet. Every cryptocurrency has transaction fees built into their basic operating structure. Bitcoin (BTC %) calls it a network fee, Ethereum (ETH %). The intensa-promo.ru Crypto Wallet is the easy-to-use, multichain, self-custody crypto & Bitcoin DeFi wallet that puts you in full control of all your. Join Coinbase One today and get % APY on your first $30, USDC, zero trading fees, priority support, and more. Store your crypto in your own personal. Best bitcoin and crypto wallets · Coinbase Wallet Web3: Best bitcoin hot wallet. · Ledger: Best bitcoin cold wallet. · SafePal: Best crypto hot wallet. · Ledger. Table of Contents · Security · Reputation · Access to private keys (owning your bitcoin) · Backup features · Fee customization · Multisig (shared wallets) · Other. Best Cryptocurrency Wallets At A Glance ; Zengo Wallet · () ; OKX · (51) ; Fireblocks · (29) ; Coinbase Wallet · (67) ; Metamask · (42). The Best Crypto Wallet| ; Bank Fee. EUR ; Network fee (included). 1 TRX ; Service fee. EUR ; Rate updates in EUR/TRX How Much Are Fees for Crypto? Most cryptocurrency exchanges charge between 0% and % per trade, depending on whether you're a maker (buyer) or taker (seller). Lykke is the best Bitcoin (BTC) exchange and Ethereum (ETH) exchange popular amongst traders looking for the lowest fees. Very low trading limits. We admit. Off all these options, Kraken offers the most competitive rates at % for credit card fees. Coinbase comes with the Coinbase Card that charges 0% fees for. Open the Mac App Store to buy and download apps. Trust: Crypto & Bitcoin Wallet 17+. Best and Secure Crypto. Find the top 10 cheap crypto exchanges in , offering low fees for trading Bitcoin, Ethereum, and more, with insights on their unique fee structures. Users can start transacting Bitcoins by just creating an account. There is no transaction fee and hidden cost. Speed Bitcoin wallet app supports over Buy, stake, swap, and manage cryptocurrencies with the best Cryptocurrency Wallet & Bitcoin Wallet. Secure Atomic Wallet for your crypto assets and NFTs. Verdict ; One of the best hardware cryptocurrency wallets ever made. ; The new-and-improved Nano S hardware cryptocurrency wallet from Ledger. Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps).

How Much Should I Invest In Stocks For My Age

At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. About how much money do you currently have in investments? This should be the total of all your investment accounts, including (k)s, IRAs, mutual funds. Those in their 60s keep % and % respectively. Older investors in their 70s and over keep between 30% and 33% of their portfolio assets in U.S. stocks. Many financial advisors recommend a 60/40 asset allocation between stocks and fixed income to take advantage of growth while keeping up your defenses. For example, if you're 30, you should keep 70% of your portfolio in stocks. If you're 70, you should keep 30% of your portfolio in stocks. To open a trading account to buy or sell stocks, you must be the age of majority in your province or territory. In Ontario, this is age The New Life asset allocation recommendation is to subtract your age by to figure out how much of your portfolio should be allocated towards stocks. Studies. We've already talked about how investing in stocks comes with the risk that your net worth could drop. Some people tolerate risk better than others. If you're. my highest recommended general target allocation for stocks would be 80 percent for younger investors accumulating assets over a long time. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. About how much money do you currently have in investments? This should be the total of all your investment accounts, including (k)s, IRAs, mutual funds. Those in their 60s keep % and % respectively. Older investors in their 70s and over keep between 30% and 33% of their portfolio assets in U.S. stocks. Many financial advisors recommend a 60/40 asset allocation between stocks and fixed income to take advantage of growth while keeping up your defenses. For example, if you're 30, you should keep 70% of your portfolio in stocks. If you're 70, you should keep 30% of your portfolio in stocks. To open a trading account to buy or sell stocks, you must be the age of majority in your province or territory. In Ontario, this is age The New Life asset allocation recommendation is to subtract your age by to figure out how much of your portfolio should be allocated towards stocks. Studies. We've already talked about how investing in stocks comes with the risk that your net worth could drop. Some people tolerate risk better than others. If you're. my highest recommended general target allocation for stocks would be 80 percent for younger investors accumulating assets over a long time.

Based on those assumptions, we estimate that saving 10x (times) your preretirement income by age 67, together with other steps, should help ensure that you have. For example, if you are age 40, 60 percent ( minus 40) of your portfolio should consist of stock. For example, if you accept an early retirement package at. Many people of working age will benefit from a workplace pension, a way of saving for your retirement that's arranged by employers. For all but the highest. Many companies offer investors the opportunity to buy either stocks or bonds. Your investment professional should understand your invest- ment goals. Some recommend portfolio asset allocation by age, under the assumption that the younger you are, the more aggressive you should be with your retirement asset. The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to minus your age. You can choose to add both to your portfolio. See why it matters. Learn more. How much should you invest in stocks or bonds? See how 9 model portfolios have. Since all your retirement needs are covered for you what does it really matter how much risk you assume in your portfolio? I started investing. Stocks and bonds (public investments) are usually only one portion of your overall net worth. In addition to public investments, the average person should also. of their lower fees, enjoyed higher returns than the average man- aged fund. Your investment professional should understand your invest- ment goals. your investment goals and how much risk you You should always consider their appropriateness given your own circumstances. SoFi Invest®. INVESTMENTS. Many of the experts we spoke with suggested, as a general rule, to invest a set percentage of your after-tax income. Although that percentage can vary. Your current age. This is by far the most important aspect of asset allocation. For most people the majority of their portfolio is for their retirement. The. Investing 15% is the magic number. Select speaks with a CFP about a 50/15/5 rule to help you stay on track. The number one drawback of having too much cash is that you may be sacrificing the return potential of investments in stocks and bonds. Keeping too little. That said first and foremost, I would say your money should be aggressively invested in individual stocks. In fact, my managed. As with other important investment decisions, you should speak with your financial advisor or a representative at your financial institution to be sure you. the possible loss of the money you invest. Prices of mid- and small-cap stocks often fluctuate more than those of large-company stocks. could lose money. Your investment portfolio allocation should align with your financial goals How do you choose how much you want to invest in stocks or bonds? Asset. So how much of your income should you allocate to your investment account? A popular guideline is the 50/30/20 rule. This rule of thumb says that 50% of your.